|

| Image created by Aria - AI by Opera |

Every time, since the beginning of wireless communications and faster internet India stood as a back bencher compared to global standards - either India joined late or could not deliver what was promised. For eg, 3G/HSPA/HSPA+ was first launched in 2001 in Japan by Docomo and Airtel came with 3G in 2011, which took nearly 1.5 year to go mainstream. And it was never affordable at all.

Cut to 2016, country's richest man Mukesh Ambani backed Reliance Industries unleashed Jio to Indians with 4G-LTE. Wireless data became affordable, cluttered out non-serious players from the market and incumbents responded to Jio's move.

In another 6 years, Jio geared up for 5G and India got first commercial 5G signals from Jio and Airtel on October 1, 2022. Incumbent Airtel had to go side by side with its competitor.

After a year, the 5G footprint has expanded exponentially across the country - Airtel 5GPlus is available in over 5,000 cities and towns and Jio True5G in over 7,700 cities and towns with target to go nationwide 5G coverage by Q1 of 2024. I would rather say India’s 5G deployment is not one of the fastest in the world, it is the fastest 5G roll out in the world.

Today out of 4 operators in India, 2 operators have launched 5G in a mass scale (not simple commercial launch to fulfil government's mandates) - that's more than 75% coverage! While GSA has identified 121 operators in 55 countries and territories worldwide that have been investing in public 5G Standalone networks in the form of trials, planned or actual deployments (Data of December 2023). This equates to 20.9% of the 578 operators known to be investing in 5G licenses, trials or deployments of any type.

India has seen the fastest 5G deployment but right now there is no extra charges for using 5G data. In fact Jio started offering unlimited 5G data to selected customers initially. Later Airtel also did the same. Right now anybody can get 5G data by recharging selected 4G packs.

In July 2024 Jio's strategic head, Angsuman Thakur reported that 5G data accounting for 31% of overall data traffic on their network.

However Indian operators Jio and Airtel are yet to find a way to monetize 5G. '.... curiously, this seems to be the fate of the odd ones—1G, 3G and 5G', as many telecom experts believe.

The main roadblock of monetizing 5G is despite fastest roll out of 5G tech it is yet to get blanket coverage like 4G. 4G is still being used for voice, even if you are on 5G data. Airtel's NSA (non-standalone) 5G still depends on 4G infrastructure, though Airtel also rolled out SA 5G in July 2024, and many circles Airtel's 5G is actually NSA 5G. While Jio, being launched as greenfield 4G service provider, use SA (standalone) 5G-NR (new radio).

5G fails, notes SK Telecom

Almost a year back (to be specific in August 2023), South Korean telecom firm SK Telecom declared 5G was over-hyped, has under-delivered and has failed to deliver a killer app in their white paper titled, "5G Lessons Learned, 6G Key Requirements, 6G Network Evolution, and 6G Spectrum." The paper recalls 5G being sold as an enabler of autonomous driving, unmanned aerial vehicles (UAM), extended reality (XR) and digital twins - but sadly that could not happen due to several factors like device form factor constraints, immaturity of device and service technology, low or absent market demand, and policy/regulation issues. Interestingly the paper notes 5G technology's performance was not a issue, and it cuts down tariff. The paper also says that success of 6G will depend on the development of AI and sensing technology, for eg, Level 4 full autonomous driving will require 6G.

Airtel and Jio have invested approx. $25 billion on 5G including spectrum, trials and rollout - the user base reached 165 million (= 16 Cr 50L) on March 15, 2024. Still 4G base stations stand at more than 24L while 5G base stations are at around 4.2L. In July 2024 they again bought spectrums.

Telcos were waiting for a tariff hike - which happened in July, 2024 and that was an overall tariff hike (upto 30%) - still no extra cost for 5G. May be telcos thinking why people pay premiere for 5G which is yet to provide best coverage.

First thing to monetize 5G is launching FWA (fixed wireless access) - which both Airtel and Jio are offering as AirFiber. The last mile connectivity issues with Fiber broadband has been easily overcome by 5G-FWA. This is a good revenue generating mode from home and small business customers.

Could AirFiber replace Fiber broadband? I don't think so. Personally I have used both of Jio - Jio Fiber is more stable than Jio Air Fiber. Speed is not a benchmark here, as you can choose the speed. But latency of AirFiber services is a big issue for concerned users. I often find Jio Air Fiber goes numb - no internet access error on my devices.

If you go by the history, FWA is already being used by operators since 3G, as 3G WiFi Hotspot to tackle last mile connectivity. Later operators got advantages with LTE, LTE Advanced and now with 5G to deliver residential and business broadband services in locations that are poorly served, or not served at all, by fixed-line broadband technologies based on copper, coax or fibre.

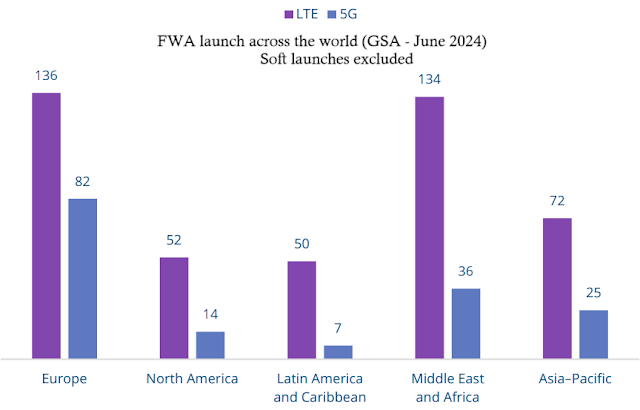

Globally FWA is becoming very popular - GSA's June '24 data shows 562 operators in 188 countries and territories announced FWA offering on LTE/5G; and 493 operators in 176 countries and territories already launched the services.

Other developments for 5G:

Jio has created a subsidiary - JioThings for IoT and targets the enterprise segment. Jio is already in enterprise business as they offer connectivity and value-added services such as cloud, chatbots, cloud communications platform (CPaaS), and vertical-focused solutions. Similar offerings are also provided by Airtel to business segment.

Jio is now busy in expanding its wallet share across connectivity into value-added services. The telco is building partner ecosystems to tap into opportunities, especially in some specialized sectors where getting access through partner ecosystem is easier and faster. Jio’s IoT solution consists of a trio of connectivity, device, and software elements, as well as, the platform. Jio's offerings are seeing good uptake in banking, financial sector and insurance sector (BFSI) and also in education, manufacturing, and hospitality.

Jio, in July 2024, initiated a partnership with Taiwanese chipset maker, MediaTek to use later's IoT solutions to tap the two wheeler and electric vehicle (EV) market in India. The two companies, under the long-term strategic collaboration, will deliver Android-based smart digital cluster solutions in India and the global market. MediaTek has its own range of IoT chipsets, Genio.

Jio is also invested in machine learning, and created a distributed ML platform - JioBrain. It has the capability to train and apply ML at the network edge and service provider cloud. Know more -https://www.jio.com/platforms/offerings/automation-ai-ml-platforms/jio-brain/

On this context, I am noting down IntentCX - a new AI platform created by T-Mobile and OpenAI to automate engagement with customers and to understand customer churn. (September 2024)

AI-Powered Airtel's Anti-Spam Iron Dome: In the end of September, 2024 Airtel announced AI powered solution to curb spam calls and texts over its 4G network. Gopal Vittal, Managing Director and Chief Executive Officer, Bharti Airtel explained in the press conference that 400 data scientists of Airtel worked for last 12 months to develop this two-layered shield. This network driven, AI powered solution uses a proprietary algorithm to identify and classify spam calls and texts very fast - this shield processes 1.5 billion messages and 2.5 billion calls in 2 milliseconds.

Much of surprise, BSNL also announced similar solution to tackle spam calls and texts which would be backed by Artificial Intelligence (AI) and Machine Learning (ML). This solution will be showcased during India Mobile Congress, to be held in October '24.

I think Jio and Vi will follow this trend soon. This is due to the fact that in June '24 TRAI asked operators to use new gen technology to detect unauthorized commercial communications. During that time Vi proposed a ML/AI based solution and TRAI permit to conduct trials.

Jio and TWO.ai

Back in February 2022, Jio Platforms and Naver (South Korean internet conglomerate) invested $20 million as seed fund in an US based AI start up called TWO.ai. TWO has launched a family of models called SUTRA. These cost-efficient, multilingual generative AI models excel in 50+ languages, offering speech, search, and visual processing capabilities. The model is available on the ChatSUTRA app, similar to ChatGPT.

SUTRA surpasses leading models (GPT 3.5 and LLAMA 3) by 20-30% on the MMLU benchmark in comprehending and generating responses across numerous languages.

As India is a multi-lingual country, it seems that Mukesh Ambani's investment in TWO.ai would mark a great deal in coming future.

Get Money by Selling Technology

Jio has developed their own 5G stack, and want to monetize that investment. As per June 2024 report, Ambani backed Radisys will deploy their 5G tech in Ghana. (Read more)

Going by the same way, though late, BSNL's 4G tech and eventually 5G tech are also developed (and will be developed) by home grown companies like Tata backed Tejas Networks and Tata Consultancy Services. We can expect that Tata would export this technology to other countries.

Airtel's take on 5G Monetization

In January, 2024 Airtel Business, the B2B arm of Bharti Airtel was chosen by Adani Energy Solutions Ltd to deliver real time connectivity and smart IoT for 20 million smart meters across the country. Airtel’s IoT platform, the Airtel IoT Hub, will be integral to the project, offering tracking, monitoring, analytics and diagnostic services. The announcement was done in January 2024 and Airtel will use mostly its 4G and 2G network.

To team up Airtel strategically partnered with IntelliSmart Infrastructure Private Limited, a leading smart metering and digital solutions provider to power up to 20 million smart meters of Adani Energy.

So far Airtel's investment in future tech is nothing compared to Jio. However Airtel is working with several tech giants as well as with small companies including start ups for the future. May be Airtel wants to stick to be a service provider only.

No comments:

Post a Comment